How will you pay for college?

If you haven't made a plan to pay for college this fall don't fret! Start by making a plan.

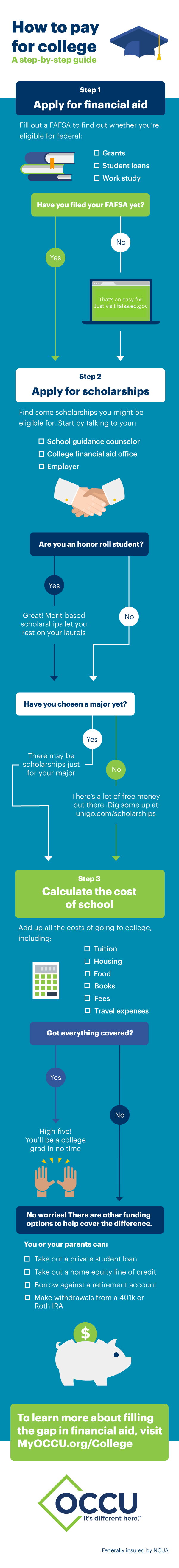

From getting started with your FAFSA to exploring non-traditional funding sources our flowchart walks you through various funding options to make a plan.

How to pay for college

A step-by-step guide

Step one: Apply for financial aid

Fill out a FAFSA to find out whether you’re eligible for federal:

- Grants

- Student loans

- Work study

Have you filed your FAFSA yet?

No

That’s an easy fix! Just visit fafsa.ed.gov

Yes! Move on to step two

Step two: Apply for scholarships

Are you an honor-roll student?

Yes: Merit-based scholarships let you rest on your laurels

Do you play sports?

Yes: Athletic scholarships help student athletes pay for college

Have you chosen a major yet?

Yes: There may be scholarships just for your major

No?

There’s a lot of free money out there. Dig some up at https://www.unigo.com/scholarships

Step three: Calculate the cost of school

Add up all the costs of going to college, including:

- Tuition

- Fees

- Books

- Housing

- Food

- Travel expenses

Got everything covered?

Yes: High-five! You’ll be a college grad in no time.

No: No worries! There are other funding options to help cover the difference. You or your parents can:

- Take out a private student loan.

- Take out a home equity line of credit.

- Borrow against a retirement account.

- Make withdrawals from a 401k or Roth IRA.