What it means to bank with a not-for-profit credit union

Do you ever get tired of being seen as a just another customer? We do.

In today’s marketplace, it often seems like the world is divided into commodities and the people who consume them. We think businesses can do better. As a not-for-profit organization, we’re working alongside credit unions across the nation to pioneer a different way of doing business.

But when we say we’re not-for-profit, what do we really mean? What is it that makes us different?

The not-for-profit difference

Unlike for-profit banks, which pay their profits to outside shareholders in the form of stock dividends, “not-for-profit organizations must reinvest all their profits in ways that exclusively benefit the organization or its members,” says The Financial Brand.

Everything a credit union earns is returned to its members in the form of reduced fees, higher savings rates and lower loan rates. For example, credit union members pay, on average, nearly a third less in checking fees than bank customers. And a consumer who finances a $30,000 new car can save more than $1,000 over the life of the loan by choosing a credit union rather than a bank.

Credit unions also invest their income in financial education to provide the “cultivation of thrift, encouragement to save regularly, and budget and consumer counseling” that have become an integral part of our mission.

But being a not-for-profit organization means so much more than that. It affects everything we are and do — including how we’re owned and governed. Credit unions, by nature, are:

- Owned by our members. Credit unions function as cooperatives, owned and controlled by the people who use our services. That means there’s no difference between our members’ needs and our own.

- Democratically governed. Each credit union is governed by a board of directors elected by its membership. Every member gets an equal vote regardless of how much money they’ve invested.

- Dedicated to social good. Credit unions don’t exist to do business; we exist to fill a social need. While most companies are committed only to their bottom line, we live and breathe our mission to help others.

Financial institution with a social mission

Every not-for-profit organization in the nation fulfills some sort of civic or social role. According to the IRS, credit unions were established in large part to provide a specific public service: Give loans to people with small means who might not otherwise have access to credit.

To this day, credit unions remain “the only financial institutions chartered with the social mission of making loans available to people of small means and teaching the benefits of thrift,” said the former chairman of the Credit Union National Association.

By providing a safe place to save and borrow at reasonable interest rates, credit unions help bolster the financial health of the communities they serve.

“The cooperative structure of credit unions creates a cycle of mutual assistance towards the common goal of the financial well-being of members,” says the National Credit Union Administration. “One member’s savings becomes another member’s loan.”

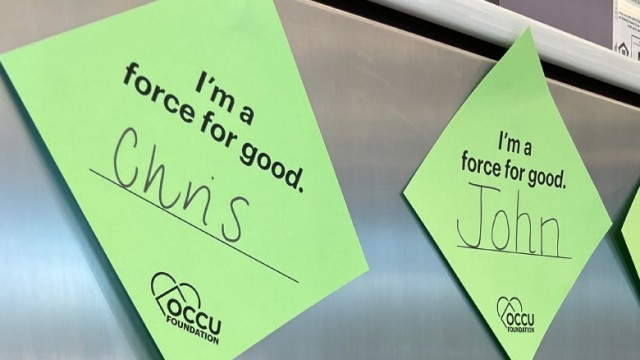

At OCCU, we strive to make a difference in the lives of members and in our communities. We're committed to our vision to Enrich Lives and living out our three values each day:

- Tenacious. We're dedicated and show up for our members with care.

- Humble. We support a culture of helpfulness by serving our members and one another.

- Big-hearted. We're active in our communities and give our time to support our members and places we live.

How to join a credit union

Joining a credit union is easy! To qualify, all you have to do is belong to the community we serve.

While some credit unions serve a specific population, such as people who work for the same employer or attend the same social group, most are open to anyone within their community who wants to join. You’re eligible for OCCU membership if you:

- Live or work in our 67-county membership area.

- Are an immediate family member of an OCCU member or someone living in membership area.

- Are a student or employee of the University of Oregon or member of the UO Alumni Association.

- Are employed by Bi-Mart or is an immediate family member of an employee.

- Are a Bi-Mart store member or an immediate family member of a store member.

- Are employed by the State of Oregon.

When you create a checking or savings account with OCCU, you automatically become a member — and part owner. That makes us invested in your financial well-being.

As your community financial partner, we’ve made it our mission to help you achieve your definition of financial wellness.